Do you want to make money in the world of NFTs? The digital art market has exploded, with some artworks or NFT collections selling for millions of dollars. But how can you get in on the action and make profits for yourself?

When making money out of these digital assets, one of the most common practices is NFT flipping. This technique allows investors to make profits quickly, especially when dealing with rare NFTs or a promising NFT project.

Flipping NFTs can be a lucrative business, but it requires knowledge, skill, and a bit of luck. You must pay attention to many details to guarantee a successful sale and avoid problems like scams or selling a digital asset for the wrong price.

In this article, we’ll guide you through the process, providing tips and strategies for success in the ever-evolving world of NFTs.

Be sure to follow each step carefully to avoid problems during the process. Any mistake can lead to issues with the NFT projects and your account.

This article is a segment of a more extensive piece :

What Is NFT

If you still don’t know what an NFT is, you are really late but don’t worry. We got you covered.

Non-Fungible Token (or NFT) is a unique digital asset stored in blockchain technology that can not be replaced by anything else. This is the main difference between these and traditional crypto tokens, like Bitcoin and Ethereum.

Think of it like a fancy trading card or a rare book. Just like how some people collect things like that, some people collect NFTs because they’re special and unique. It’s a way to own a piece of the internet that’s truly one-of-a-kind.

Thanks to its uniqueness, each token has a different value chosen by the seller. The floor price will depend on factors such as rarity and traits.

Although many people think that NFTs are only related to arts and illustration, this technology’s possibilities are almost endless. The NFT space can go from photography to an ID or tickets for a show. For example, A 10-second video clip of a flying cat called “Nyan Cat” had been turned into an NFT and sold for nearly $600,000.

What Is NFT Flipping

Before explaining what flipping NFTs is, it is essential to clarify that this kind of action is not new, and people have been flipping collectibles since always. From baseball cards to limited-edition stickers, this technique has always been used to get a quick profit.

Flipping NFTs is the action of buying or minting NFTs and then selling NFTs at a higher price on secondary NFT marketplaces. The main objective of this strategy is to buy undervalued NFTs or new collections with high demand and then sell them on the secondary market for a better deal.

There are tons of NFT platforms for people who want to purchase NFTs and flip them. The greater its value, the better your profit can be.

Why Is Flipping NFTs a Good Investment

As previously mentioned, the NFT market is growing faster than ever, and we see tons of new collections that generate an enormous trading volume and a high demand for the pieces.

If you know how to sell and buy NFTs, flipping tokens is a great tool to generate profit through this demand quickly. You can flip NFTs for profit without worrying about risks as much as when trading crypto. Moreover, there are always other projects appearing that can become opportunities.

You can find more NFTs to flip by doing your own research.

Minted NFTs vs. Secondary Market NFTs

Before you start to flip NFTs, there are some critical details that you need to know. One of

them is the difference between minting NFTs and buying them from secondary markets.

Minted NFTs

If you have a minted NFT, it means that you were the first one to buy it. They are usually related to whitelists, which are the benefit of being selected as one of the investors to receive a piece of the collection.

These collections usually have a higher floor price when flipping NFTs since they have an enormous demand. They are great for NFT flippers looking for the quickest profit possible since the value of these pieces tends to increase very quickly.

Secondary Market NFTs

Regarding secondary market pieces, the NFT is sold from one investor to another. In this case, NFT flippers usually look for undervalued NFTs that can be sold for a higher price.

The profit in these cases is not as big as in minted NFTs, and the floor price may not be that high as well. When selling second-market NFTs, you must choose a bull market to upload the asset. A bull market is simply a trending market with a high number of active users.

One great example is OpenSea. It is the largest NFT marketplace available and counts thousands of active users every day.

It is a great place to buy NFTs and flip. It presents an enormous trading volume that features various rarity tools to help decide the best floor price for your NFTs.

How to Flip NFTs

Now that you know what NFT flipping is, it is time to see how to do it the correct way. From the market you choose to the digital art you are selling, everything may impact your sales.

Be sure to follow each step to guarantee good deals and sell high-value NFTs. Here are a few tools and tips to help with this task:

Analyze the NFT Project

The first thing you need to do when choosing NFTs to flip is to analyze the project you’re considering investing in and the data regarding it. This information is your best friend if you want to make low-risk profits.

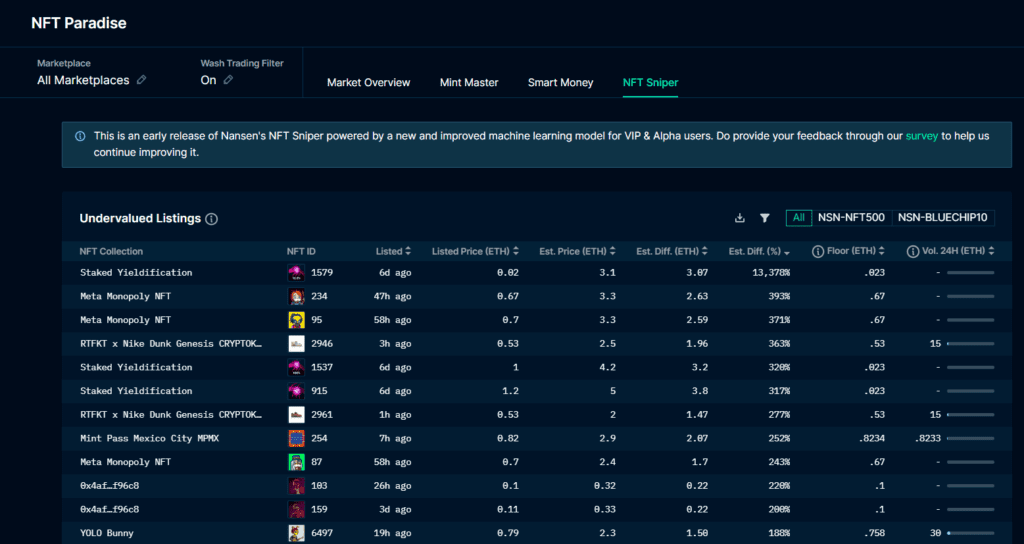

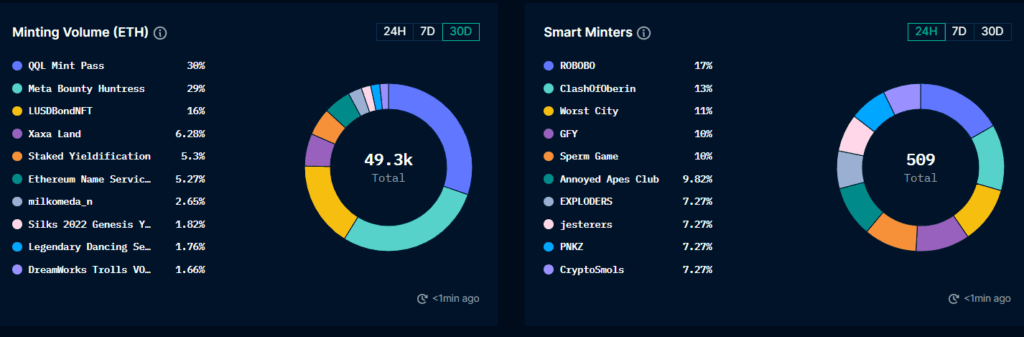

For analyzing that kind of information you can use NFT Paradise. The website compiles all the necessary data regarding collections and pieces that you might have interest in. When looking for suitable projects, it is worth learning to accurately assess the value of a specific NFT.

By this data, you can tell if the project is worth investing in and can generate profit. If the numbers are not good, you might want to look for new projects.

If you are looking for a valuable project, you can check out the list of best upcoming nft projects.

Floor Price

This information is vital when analyzing projects. The floor price is the price regarding the cheapest asset of the entire collection on a secondary market.

The higher the demand for a digital asset, the higher its floor price will be. As an NFT flipper, the ideal scenario is to buy the asset when it has a low floor price and sell it when that value is high.

Actions like higher trade volume and collaborations tend to increase the floor price. There are graphic tools designed just to keep track of this kind of information.

Trading Volume

As we said, the trading volume also directly impacts the price of an NFT project and its assets. The higher this volume, the more expensive the collection pieces will be.

Not only that, but it also indicates the level of interest in the project. Good trading volumes mean easier sales.

Liquidity

Liquidity is also a crucial indicator of which NFTs to invest in. This data represents the speed at which something can be sold.

This number is also impacted by the volume of trades. The higher the volume, the more liquid an asset is.

When looking for NFTs to flip, higher liquidity means it is easier to sell. You must pay attention to this information if you are looking for the quickest profit.

Holding Time

The last detail you need to analyze is the holding time that investors have regarding the assets. If someone has the NFT in the wallet for a long time, they expect a price appreciation.

Waiting for the right time to sell the NFT will result in higher profits. You must pay attention to graphics and data to tell the best time to do it.

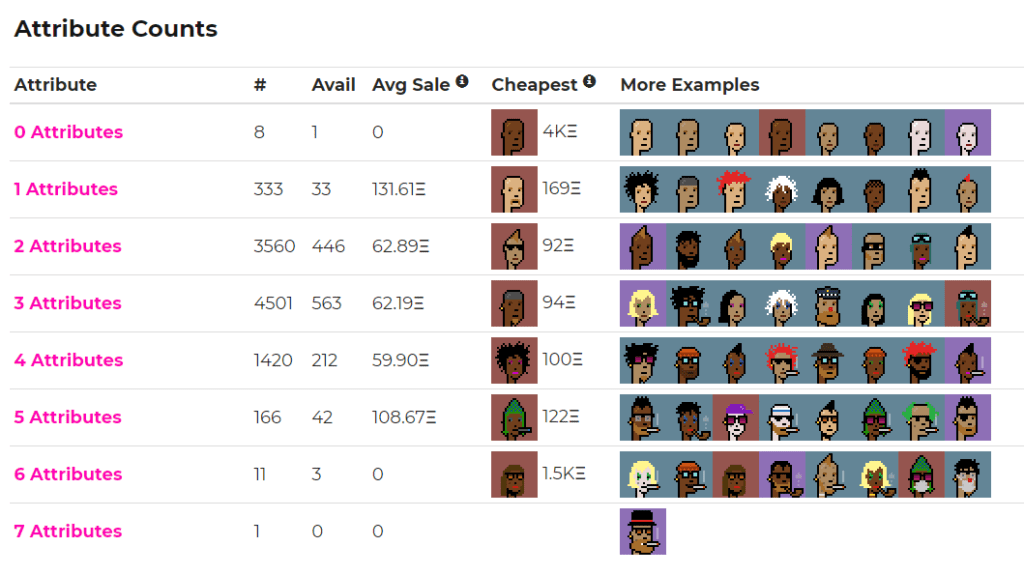

Traits of the NFT

Along with the project details, another thing that can dictate if an NFT is worth investing in is the traits of the asset. The rarer the traits, the higher the sale prices will be.

Pieces with multiple rare traits are the most desired item from any collection. If you get to purchase one of these pieces, especially when minted, you have a treasure that can grant an enormous amount of money.

To get these pieces, you must look for them in multiple marketplaces for second market options or follow all social media accounts of the project if you want a minted one. Making profits out of these NFTs is generally easier and quicker when compared to “more common” items.

Choose Quality Marketplaces

One of the key factors that can impact your flipping profits is the marketplace you are using. You should use only trustworthy marketplaces when flipping NFTs or looking for new projects.

This will give more credibility to your NFTs and make it easier to sell them. Bigger marketplaces mean a higher volume of daily users and more people seeing your assets.

Moreover, famous marketplaces also mean safer transactions. By using marketplaces like OpenSea or SuperRare, you have the certainty that both you and your customers will be safe.

Extra Factors to Look Out For When Choosing a Project

Along with the previous factors, there are some other details that are worth considering before making a decision. Doing this will guarantee that you are making the right investment to generate a good return.

Artist and Founding Team

One key factor that makes a project get hyped is the founding team and the artist responsible for it. If the collection you consider investing in has a famous artist behind it, there are greater chances of it being successful.

Beginning artists generally have lower price assets since they are starting in this universe. But remember that the more hype a collection generates, the harder it is to get a minted NFT.

Art

The art style can also impact the value and impact of a collection. 3D and highly detailed NFTs are usually more expensive and more sought after. It might be a better investment to prioritize this kind of NFT.

Conclusion on Flipping NFTs

There is no doubt that flipping NFTs is one of the best techniques if you want to invest in the NFT world and generate a quicker profit. Many projects and assets appear daily, making the look for the perfect piece even easier.

Remember to pay attention to all the important information when analyzing which NFT to buy. Every aspect will have a different impact on your sales and the final value differently.

Moreover, you must stick only to trustworthy marketplaces to avoid problems with scammers or hackers trying to steal your wallet. Besides, a good marketplace always attracts more clients.

Now that you know everything about NFT flip, it is time to start looking for the perfect art to invest in. There are tons of options, from minted ones to second-market illustrations. You will definitely find what you are looking for. If this is your first NFT purchase, you can start investing in cheaper NFTs.

After deciding which one to choose, you just have to wait for the right time to sell it. Remember that patience is your best friend when you want to generate higher incomes.

Read also: