The NFT world is a volatile market that requires work to create valuable content. And now that NFTs have proven they are not just a trend, artists worldwide are increasingly creating art to sell and make a living.

The problem comes when they only profit from the primary sales rather than the resales. This drastically cuts their profit margins if the artist’s work becomes too valuable.

What can creators do to ensure a recurrent income from resold NFTs?

Apply royalties.

This is a strategy the NFT creators have started to fund their work and ensure a steady source of income without having to recur to streaming platforms or streaming services to sell NFTs.

But how does it work?

This article helps you understand how royalties have network effects on the crypto community.

- Defining NFT Royalties: What Are They?

- How do NFT Royalties Work?

- Where Can You Apply NFT Royalties?

- Are NFT Royalties Trustable?

- Advantages and Disadvantages of NFT Royalties

- What Do You Gain From Reselling NFTs?

- Calculating Royalty Payments & Royalty Percentage

- How To Add a Royalty Fee To An NFT

- Other Ways To Build Passive Income From NFTs

- NFTs, Creative Works For Income Perpetuity

- NFT Royalties – FAQ

Defining NFT Royalties: What Are They?

An NFT royalty is a fee NFT artists receive whenever their work is sold. NFT creators build a solid income stream using a smart contract to get permanent profit. This is a way to access a secondary market and encourage creators to keep crafting their art.

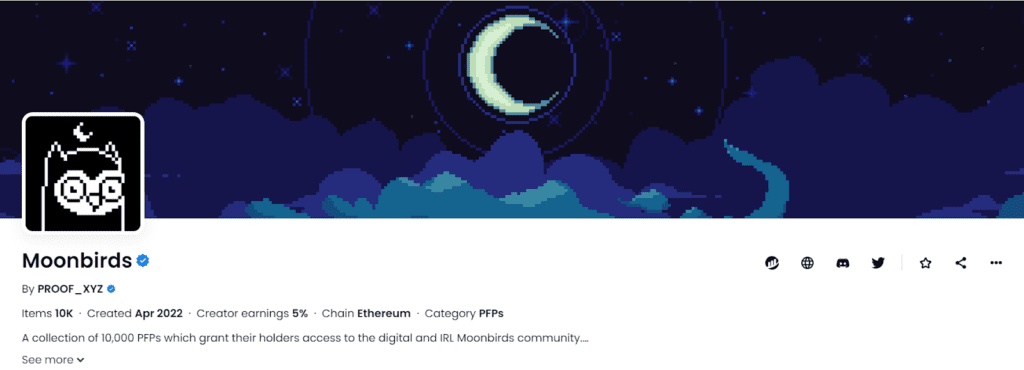

Digital collectibles spread through the blockchain, allowing artists to use the NFT royalty system to gain something from reselling and secondary sales. The percentage they receive varies according to each creator, so you could find pieces in the NFT market with cuts from 1% to 6%.

The platforms where the NFTs are sold are in charge of automatically sending payments.

How do NFT Royalties Work?

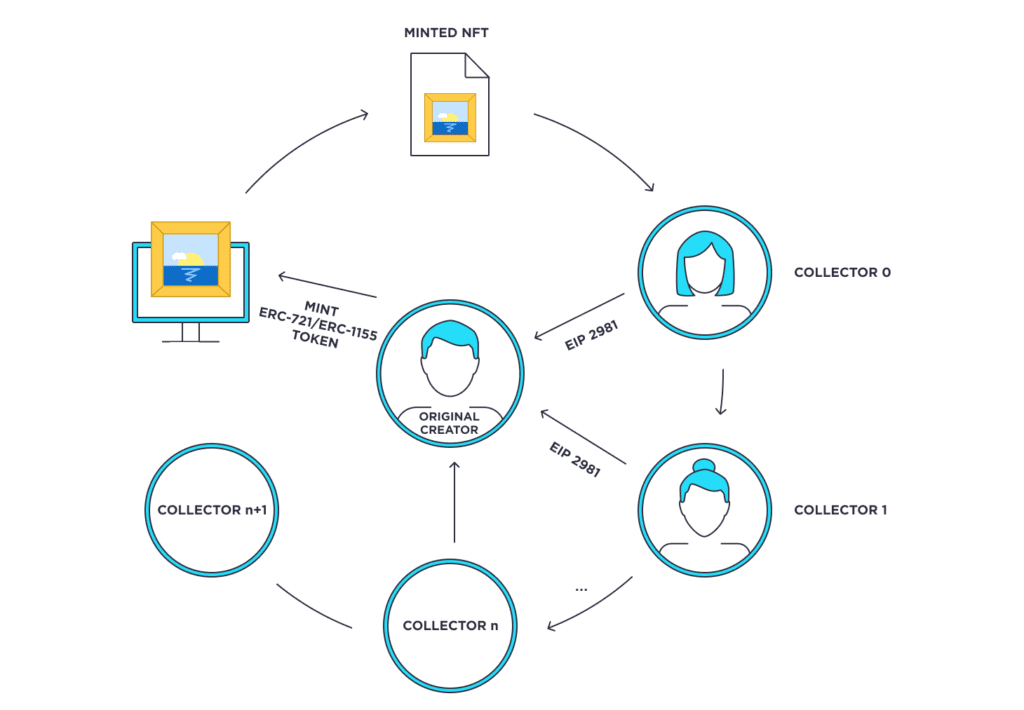

Resale royalty rights work alongside the NFT royalty system. That is, creators mint an NFT and add the royalty percentage they want to receive each time someone else sells their art. This is made through smart contracts that execute all orders and identify when a secondary sale is made.

The creator royalties are possible thanks to the Distributed Ledger Technology from blockchain, which allows you to preserve the integrity and authenticity of all your work. It also is the key to the smart contracts’ right execution whenever a purchase is made.

So, whenever a platform pays royalties, blockchain helps identify – with the help of smart contracts – if it’s a primary or secondary market sale.

Hence, artists receive their payment right after the transaction is completed. That said, there are no risks, and the author ensures they will get paid for their work.

Let’s give you an example:

You’re an NFT artist minting a new NFT. You set up a royalty payment of 6% for future sales.

After creating your digital art, list it and sell it for 20ETH. You wouldn’t receive any royalty here. Instead, you would get the total price. This is when the resale proceeds. The new owner will list your NFT at a higher price – let’s say 30ETH – and wait for someone who loves your art to buy it.

If the subsequent sale happens, you’ll earn 6% of that transaction – 1,8ETH. This is how you create passive income. Content creators collect royalties as long as the digital asset keeps selling.

You don’t have to worry about intellectual property because NFT smart contracts are specific and can’t be manipulated.

Where Can You Apply NFT Royalties?

You can apply a royalty revenue system to any NFT on any platform that lets you do it. Some of the digital assets where it’s common to use royalties are:

- The music industry

- In-game items

- Photography

- Visual art

Visual artists, musicians, and all digital artists deserve fair compensation. A smart contract ensures this, along with the use of the royalties added to it.

Before NFT royalties, original creators weren’t paid what they were worth. Now, the NFT ecosystems allow them to add royalties and earn money with automated protocols.

Are NFT Royalties Trustable?

NFT Royalties aren’t regulated by any legal jurisdiction. Still, they are stored in the blockchain, which makes them trustable. That means royalties operations are immutable, transparent, and have documentation on each transaction.

This technology helps guard the authenticity of the digital content you’re selling. Individual artists can relax because blockchain technology will enforce what the smart contract dictates.

Advantages and Disadvantages of NFT Royalties

Non-fungible tokens royalties have advantages and disadvantages that you should consider before completing a minting process. This will help you decide whether to make royalties optional or mandatory.

| Advantages | Disadvantages |

| Artists create a solid stream of passive income with NFT royalties. | Promotes copies and frauds, as NFTs are easy to replicate. |

| Earning royalties is easier as creators get known. | Based on bullish or bearish market conditions, volatility can make royalties worth less. |

| Royalties increase as NFT prices rise and subsequent sales are made. | |

| It helps differentiate the pieces of the original creator from copies. |

Every original artist should consider building a non-fungible token passive income revenue, always considering royalty policies and protocol fees to avoid all the disadvantages.

What Do You Gain From Reselling NFTs?

Reselling NFTs provides two things:

- A way for NFT holders to make a profit by selling an NFT collection for a higher price

- Steady source of income for the original creator whenever NFT buyers get a piece of their work

Still, not all NFT marketplaces allow you to add royalties to your creations.

Royalty Application In NFTs

The royalty policy isn’t written in stone. This is just a strategy that many artists use to create sustainable business models through immutable smart contracts.

Yet, this is a practice that not all platforms accept. That’s why you, as the original owner, can:

- Use optional royalties to boost the original sale of your NFT collection

- Use smart contracts to add royalties whenever a buyer decides to purchase Ethereum-based NFTS

- Use the platforms’ royalty systems

Calculating Royalty Payments & Royalty Percentage

Royalty payments and percentages aren’t a mystery to calculate. Owners are the ones who set up their percentages and conditions based on:

- How much percentage they want to obtain from royalties

- How they want to execute royalties

To calculate royalty payments, all you need to do is:

- Set up a percentage that will apply to resales

- Calculate profits based on the previous value

For example, if you apply a 10% royalty during the minting process, you can expect this value whenever someone resells your content. If a purchaser lists an NFT you made for 35ETH, you will receive royalties for 3.5ETH.

That’s why this system is like the magic Eden for creators.

How To Add a Royalty Fee To An NFT

If you want to prepare a source of income from royalties, you must do it yourself.

Here’s a breakdown of how to do it using OpenSea:

- Find your custom contracts. OpenSea only supports royalties in your collections

- Find the NFT collection you want to edit and click the pencil icon

- Establish the percentage you wish to receive. It must be up to 10%

- Select Submit to save your changes

Note: OpenSea also gives royalties in the main sale. So you can expect it after your first sale.

Read also: What Is OpenSea and What Are Its Main Features

As you can see, you don’t need any external agent or anything. You can set up an extra income in just a few steps. Other artists can do the same if their marketplace allows them.

Other Ways To Build Passive Income From NFTs

If you’re not keen on the “Royalty” concept, there are more structured ways to profit from NFT and blockchain technologies.

Here are a few ways you can do it without using intermediaries. Remember that you must have NFTs in your wallet – minted or purchased.

- NFT staking: You lock your NFTs into a platform and stake them to gain benefits as time passes. During that time, they are locked, so you can’t sell or trade them.

- NFT renting: You can rent NFTs with extra functionalities through smart contracts—for example, in-game items.

- Accessing liquidity pools: Pools use your NFT as a source of funding. Then, they use that money and lend it to their clients. If your NFT funds the LP, you’ll earn prices and other benefits.

If you don’t know what is NFT staking, NFT renting and you are interested in passive income, read this article about how to make money with NFTs.

These methods aren’t as profitable as reselling NFTs. Even when there is space for other earnings, traditional buying and selling operations give creators and collectors real profits from their efforts.

NFTs, Creative Works For Income Perpetuity

The NFT popularity won’t decrease. In fact, according to Bitcoin.com, NFT sales increased by 41%, which is why you can see artists listing new pieces every day.

NFT royalties are a reality that the entire NFT community needs to embrace. Many aspects of this practice ensure that artists are appropriately awarded while nurturing the ecosystem. It doesn’t matter if it’s short or large projects; these compensations contribute to hard work.

It doesn’t matter if you’re Tyler Hobbs who created the Fidenza NFTs and the QQL collection, or a T-shirt company trying to survive and looking for ways to fund your company. You can use this community of millions of users to build something that will benefit you – if it’s valuable and in demand.

And if you’re concerned about the possibility of fraud due to copies and other issues, you can always use different ways to create a passive income using NFTs.

NFT Royalties – FAQ

Let’s see some of the most frequent questions about NFT royalties.

Can You Transfer Royalties Between NFTs?

No, royalties aren’t transferable automatically. You need to do this for each piece of content or NFT collection you create.

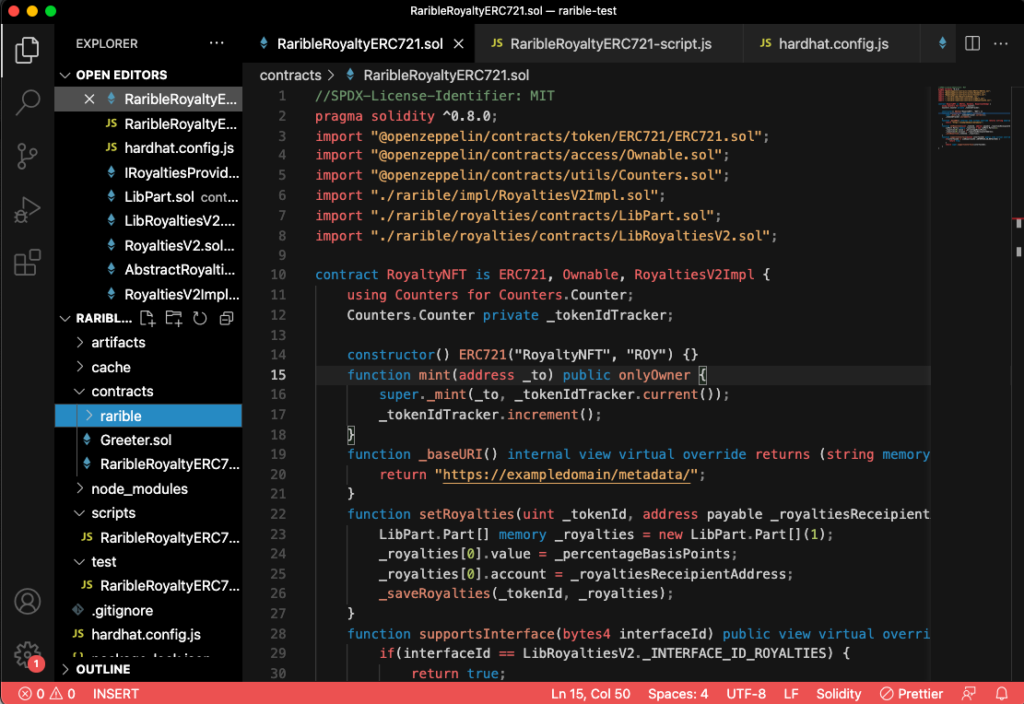

It also depends on the platform you use. Rarible supports royalties for unique NFTs and collections.

Are NFT Marketplaces Happy With Royalties?

NFT marketplaces aren’t particularly happy with owners applying royalties to their creations. This increased overall NFT prices, which is why some platforms used optional royalties.

Yet, platforms still follow the same methodology to reward artist’s work. Why?

Because NFT marketplaces that have deleted their royalty system have seen NFT trading volume plummet.

Are Royalty Fees Mandatory?

Royalties aren’t mandatory. They are made to increase potential earnings of creators and allow to create a passive income while also encouraging them to create more art.

This method benefits both the collector – because they can resell more NFT – and the artist alike while also working on behalf of the NFT community.

Can Buyers Evade Royalties?

No. Royalties are established in smart contracts or through a “tipping” platform system. Hence, buyers or collectors can’t avoid these operations. The royalty fee will execute automatically after every subsequent transaction.