The introduction of cryptocurrencies has shaken the financial world, and blockchain technology has presented us with a new kind of investment portfolio: NFTs. They gained popularity in 2021 when the NFT prices were booming, leading many mainstream celebrities to enter this new industry, showcasing their unique digital art assets and other crypto-related projects. But it is still quite a challenge to know the correct digital asset to invest in, as their value is speculative.

Blockchain technology has also accelerated and modernized the way financial businesses are conducted. Technologies like peer-to-peer lending platforms, digital wallets, mobile payment applications, and blockchain-based databases have revolutionized investing and managing financial transactions.

However, with everything going so fast and many people wanting to enter the crypto industry as NFTs transform global marketplaces, you need to know why you should get into NFT investments. More importantly, what things do you need to keep an eye on? If not done carefully, NFT investing (like it could be with any sort of financial investment) could lead you to catastrophic disasters.

So, we will review all the pros and cons of NFTs, why you should invest in them, and what you should be aware of.

What Are NFTs

NFT stands for “Non-Fungible Token,” which is called that for a good reason. One of their main features is that there can be only one piece of a particular digital asset. Each tokenized asset has its own footprint, and its uniqueness is what gives them value.

Then, its “token” aspect provides proof of ownership. With this token stored in a blockchain, you can prove to anyone that you own this NFT, giving it a high-value proposition. Some NFTs can even be combined to form another unique digital asset.

NFTs are done through different media, such as digital art, videos, audio clips, and whatever you can think of. If it can be transformed into the digital world, it can be a new NFT.

What Makes an NFT Asset Valuable

Non-Fungible Tokens don’t have value on their own. Its value resides in what people think of it and what they can gain from the asset’s ownership. In contrast to stock, NFT and cryptocurrency values aren’t determined by corporate growth, predicted shareholder payouts, or yearly profit margins.

Although, the NFT market is dictated by the people’s perception (and the initial prices when a new project launches), and the crypto market could have some influence over certain NFTs’ value. You need the proper cryptocurrency to buy a specific NFT. For example, if it is created on the Ethereum blockchain, you might need ETH. But, if the ETH price increases, inherently, the NFT price will also increase and vice versa.

Many people also purchase NFTs because of their collectible value and because it appeals to them. If you find an NFT that you like and have funds to buy it, you may want to do so. You can take advantage of the asset ownership if it is tokenized and all the extra benefits that could come with certain NFTs.

But you should also keep in mind their pros and cons, which we are going to check next.

Pros of Investing in NFTs

There are numerous reasons why one should invest in NFTs, as there are many perspectives – from a digital artist’s point of view to those who are utilizing NFTs as a new form of financial investment. That said, based on our experience, we have decided to include only the most relevant reasons that should encourage you to invest in an NFT project or become a digital artist.

NFTs Improve Market Efficiency

NFTs improve market efficiency as it allows to convert certain physical assets into digital assets. This reduces intermediaries, increases security, and improves supply chains. For example, you will have access to certain pieces of art that, otherwise, you couldn’t have as it required you to physically move to receive what you bought.

Furthermore, the lack of intermediaries allows artists to engage closer with their audience. Also, digitizing your artwork in an NFT marketplace enhances verification, reduces costs, and simplifies transactions.

Can Be Used to Fractionalize Ownership of Physical Asset

Digitalization has the potential to expand the market of particular assets. By doing so, you can digitalize a replica of physical assets and prove your ownership in the form of an NFT. And expanding the market will result in higher liquidity and price.

Individually, NFTs can improve the structure of many financial portfolios, allowing for more precise position sizing and more diversification.

Blockchain Technology Provides Better Online Security

Blockchain technology will secure your NFT ownership as this tech cannot be hacked, deleted, or altered. The blockchain is a digital record of transactions that will be replicated and distributed among its members in a peer-to-peer network.

An NFT located in the blockchain can’t be stolen or manipulated, as it has records of authenticity and chain-of-ownership. Once it is added to the chain, it can’t be removed or replicated.

This scarcity and authenticity ultimately gave them value and boosted so many NFT sales over the last couple of years. Also, all the transactions in the blockchain are transparent, making it easy to check if an NFT owner resells their digital asset.

Adds Diversification to Investment Portfolio

Adding NFTs to an investment portfolio could lead to a boost in its efficiency. But, as we will discuss next, it is riskier than investing in traditional assets, like stocks and bonds.

NFTs have different characteristics and benefits that we still need to explore further. But not being regulated by any government agency or any financial institution could lead to great risks for those who are new in the industry.

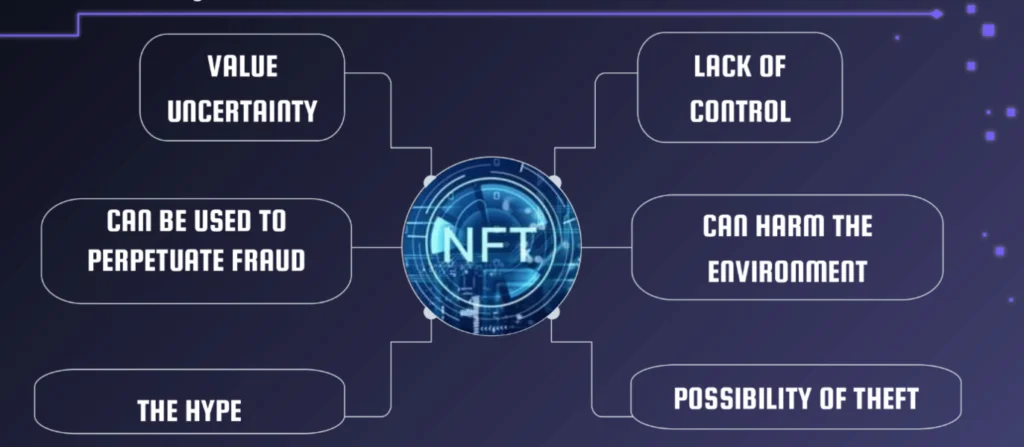

Cons of Investing in NFTs

Sometimes, the NFT industry becomes a “wild west,” as there are a lot of people confident and trustful in doing the right thing. In contrast, others use this unregulated territory to scam people.

Price fluctuations also will become a big issue for NFT marketplaces, as sometimes, a risky investment could suddenly drop from one moment to another.

They Are Volatile and Have No Liquidity

NFTs aren’t very liquid. Also, they aren’t well understood by the mainstream public and industry, which leads to a still niche market with fewer potential buyers and sellers than in other popular markets.

This results in trading NFTs being quite a challenging task to carry on, especially during bad times. And as we said, with crypto, the NFT market price can vary greatly day by day.

Many Potential Frauds Around

You will find fraudulent actors and scammers in every industry, and the NFT space is no exception. You will be fine if you use trustworthy NFT marketplaces and applications (like digital wallets) that have been proven to be secure. The problems could arise when a new “project” or “business” appears.

If you are eager to support a new project, you must do thorough research before making any decision. You need to check if they are legitimate, as there were many scams in the last year that damaged NFT’s public image as an industry.

But, even if they prove to be legitimate and have good intentions, you also need to check their technological background. In addition to scammers, hackers have taken advantage of many new developers that tried to create their own blockchain projects. But, due to not checking their security measures thoroughly, they became victims of hacking and phishing. One breach on their smart contract, one dubious link, and a hacker can empty many connected wallets.

NFTs Don’t Generate Income

Unlike real estate or investing in stocks, where people could get interested, rent, and dividends, investing in NFTs won’t give you a passive income or revenue. The return on investment on NFTs is based on price appreciation, which isn’t quite reliable.

Although there is a way to earn an income with NFTs, as certain NFT marketplaces allow you to earn royalties from further sales of your NFTs. However, only the original creator will gain some value, while their subsequent buyers won’t.

Key Takeaways

Don’t let these cons keep you away from getting into NFTs. It is a fascinating invention that is gaining traction as the industry expands.

Still, don’t purchase them with the expectation of getting a very big return. It isn’t a wise idea. The true power of NFTs lies in how they can change markets and improve how we regulate critical data.

If you are willing to be part of the NFT industry in any regard, do it wisely and in a responsible manner. Don’t go “all-in” on NFTs from the beginning. Instead, consider some low-cost positions. Otherwise, you could find yourself in a hard financial situation.