The NFT (non-fungible token) market is subject to the oldest principle of trade – buy cheap, and sell dearly. It doesn’t differ much from forex trades or stock exchanges, but you’re trading digital art, digital assets, or entire NFT collections instead. However, the metrics for evaluating values and conventional investment vehicles do not apply to NFTs. The most certain indication of value is the payment rolled out by the last buyer. It’s hard to evaluate the amount the next buyer might pay.

Therefore, many buyers lack the knowledge to forecast the value of an NFT and leave it all to intuition. Sellers aren’t in a better position either, as they can’t determine whether they will earn on tokens they hold. And considering the constantly decreasing hype of NFTs in 2022, it’s easier to lose money than earn without proper knowledge. Whether you want to buy or sell NFTs, we’ve shared essential tips to follow when estimating the NFT value or investing in a certain NFT project.

The Financial Value of NFTs

NFTs earned in value for several reasons. They’re investment instruments with high-profit potential with a strong identity, dedicated community, and ownership privileges. Some people got involved in the NFT space simply because they wanted to support their favorite artists, knowing they would profit directly from it without any intermediaries.

Apart from monetary gains, people are willing to spend thousands of $ on a single digital asset from a NFT collection for exclusivity perks. Sometimes it’s the exclusive community, closed-event access, physical collectibles, or the novelty of having your own NFT.

As you can see, the key to the success of many NFT projects is the unique background and perks that come with them. They’re like trading cards that gain high value over time. Some of them are even called Utility NFTs because of their real-world benefits. Now that you understand where the financial value of NFTs comes from, it’s time to focus on estimating their value.

Four Tips on Estimating the Value of an NFT

Whether you’re an artist or creator, you must learn to identify NFT collections with potential. Most NFT creators that became successful excelled in these four areas:

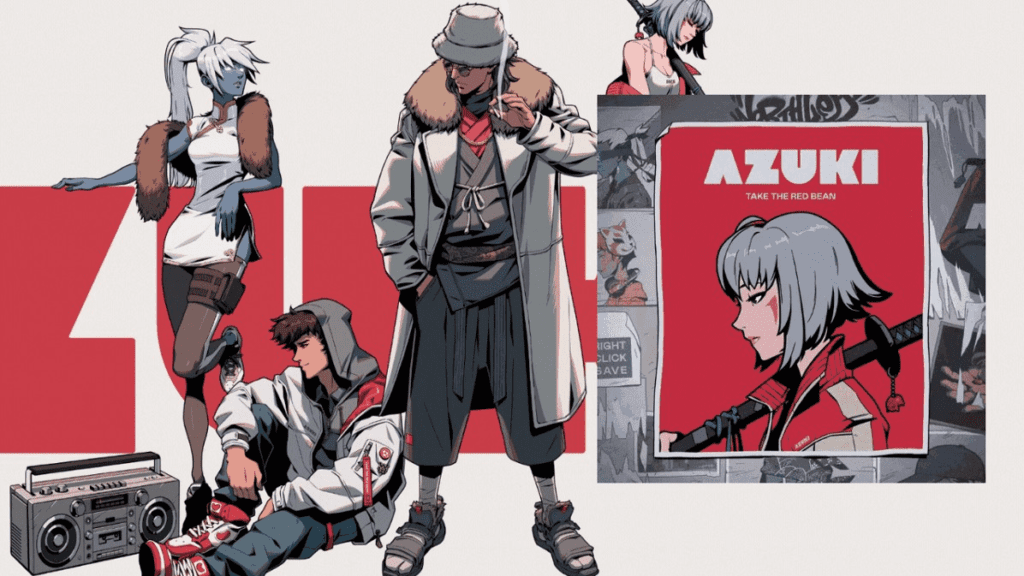

- Art. Is it eye candy, aesthetic, and unique?

- Market. How big is the addressable NFT market compared to other projects?

- Community. Is it large and dedicated?

- Artist/Team. Who are they? Do they have a track record?

Answering these questions will improve your chances for a successful NFT purchase, especially when you want to invest in a new NFT collection for a floor price. However, there is much more than that, and we’ll cover the essential tips below.

Art

The fundamental and most obvious factor when it comes to buying NFTs. The first impression is critical, and you definitely want to invest in something you like. And if you found the art appealing, there’s a high chance that thousands or even millions of people thought the same.

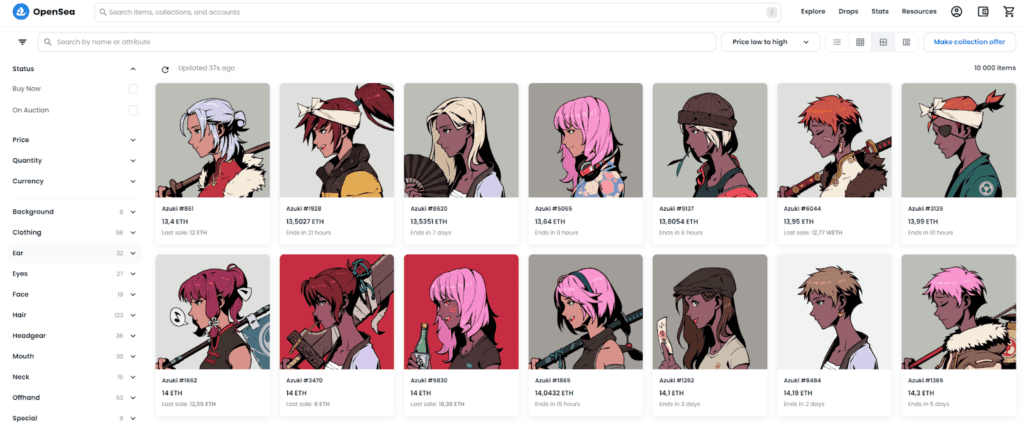

Market Size

The appearance of your chosen NFT project can tell you much about its market size. Is it a small or large collection with up to 10,000 unique NFTs? Are there rarities among the same collection? Is it open or limited edition? The scale of the project and overall interest should determine if it’s worth investing in it. Asking yourself these questions will help you determine if it will be popular in NFT marketplaces.

Community

Check the project’s social media thoroughly. It could be Twitter or any other account. What matters most here is their engagement. See if they post regularly, and check the number of likes, followers, comments, etc. However, followers don’t mean all that much nowadays since everyone can flood their accounts with bot followers.

You can easily detect this by comparing the number of likes with the number of followers. For example, if the project’s account has 50,000 followers but only 5 likes and 2 comments in the recent post, then you know it’s fake traffic. Social proof is necessary to show that the project has solid ground.

Also, find out if the community is real and active. Apart from typical social media, they should have a channel for educational purposes and a place to check and easily monitor the project’s progress. The most common practice among NFT projects is to run a Discord channel. It’s probably the best place to check behind the scenes and decide whether it’s worth investing your money in.

Artist/Team

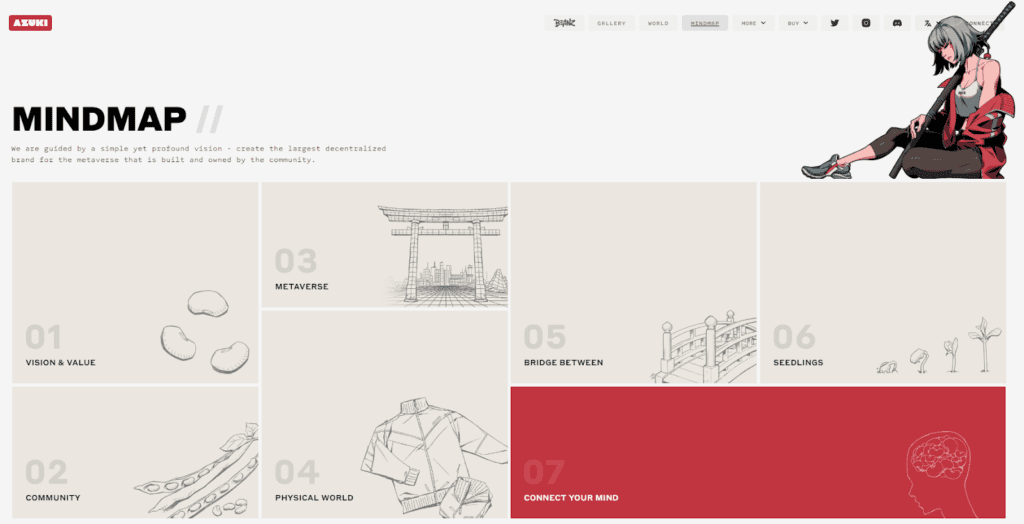

Is it a single artist or a whole team? How large is it? Are they committed? You can probably tell that by following previous tips and checking other people’s input on the project. Watch YouTube videos and read blogs.

See if the project was met with great enthusiasm or rather mixed feelings. Also, the website design can tell you a lot about the team’s commitment. The more invested they are, the higher the probability of success. Many artists involved in NFTs run their own social media, so check them out to see if they’re involved in other projects.

When to Hold or Buy an NFT?

The tips above are especially useful for upcoming or new NFTs. However, investing in already existing collections can also be profitable if you know when to invest. Of course, there are no methods with 100% accuracy, but here are more tips to follow when you plan on buying an NFT that has been on the market for quite some time.

Rarity

The demand for most NFTs is directly proportional to their perceived scarcity. Determining how rare an NFT is will help you to estimate its potential value. The prime example here is the Bored Ape Yacht Club. As you probably know, some apes from the collection have unique assets that usually refer to top-grade celebrities.

What’s more, some of them are owned by Eminem, Snoop Dogg, Jimmy Fallon, and more. You can easily distinguish them from “regular” apes by simply looking at them. And by their higher value, of course. This also applies to rare game items in blockchain games. If you’ve heard of CS: GO and its ridiculous prices for the rarest skins in the secondary market, it works similarly.

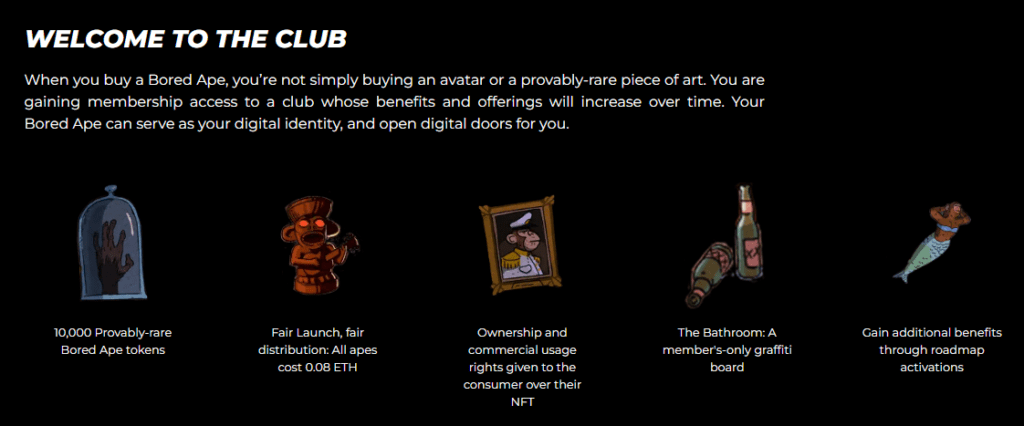

Utility and Unique Properties of NFT as NFT Value

NFTs are an asset class with endless possibilities. And while many NFTs don’t have any value outside the NFT world, some projects took it a step further. Utility NFTs provide their owners with special privileges linked to ownership. They’re not just collective artwork; they can act as a ticket to closed events or provide holders with long-term membership to a club.

Prime examples of utility NFTs are BAYC and Doodles. They provide their token owners exclusive access to branded parties or meetups. Some even offer special benefits right from the start. Coachella Collectibles grants holders a lifetime pass to a special music festival alongside some physical goods and unique on-site features. Bonuses like these can raise the price significantly, so keep an eye on special privileges.

Ownership History

Tokens created by renowned companies and famous persons highly influence their price. Like BAYC tokens, which benefit from a high ownership history value. Reselling NFTs previously held by famous people is one of the best ways to gain traction. Most NFT marketplaces usually show ownership history by providing a simple tracking interface.

Everything is protected with blockchain technology, and it also helps to fractionalize ownership of assets. Blockchain makes every record and transaction transparent, meaning the whole process is very straightforward with minimal chance of fraudulent activities.

Each NFT is like Mona Lisa – there are a thousand copies but only one original with its corresponding ownership rights. Highlighting the names of previous owners who earned a significant amount on a certain NFT trade will help you gain valuable knowledge of the potential price increase.

Liquidity

The liquidity term is used in the security market. It describes how easily a company can convert its assets into cash. It defines the company’s value and assures investors they can quickly monetize their stocks with profit. The same goes for NFTs. A high liquidity NFT is easier to resell and prone to gain value than a really expensive NFT with short ownership history.

Speculation

You can’t predict everything when investing money in any business, and NFT is no exception. Most financial instruments are based on speculation, so no wonder that non-fungible tokens are even more prone to it because of their nature. Several non-obvious factors can affect NFT prices, such as price-performance charts of NFT items, asset changes, or other unpredictable events.

The most notable example of such speculation is the price of CryptoKitty #18, which skyrocketed from 9 ETH to a whopping 253 ETH in just three days in December 2017. Of course, the Ethereum network wasn’t that popular back then. While such prices are completely non-logical, speculating lies within human nature and cannot be eliminated practically.

Therefore, you can’t predict that an NFT token you own will rapidly increase in price, like CryptoKitty #18. It’s more like hitting the jackpot in this case, without any sort of foreshadowing. However, when you notice people talking more about a certain NFT, this may indicate a sudden price increase. The NFT market is rapidly growing, and so are the prices.

Always Invest With Caution

Don’t invest in an NFT simply because it’s an NFT. Evaluate the risks, and do thorough research to see if there’s a potential for more value in the future. Our tips will help you with that, whether you set your eyes on new or existing NFT projects. Also, invest only as much as you’re not afraid to lose.

With NFTs, everything is changing rapidly, so open your mind to novelties while also being careful in the NFT space. Good luck!